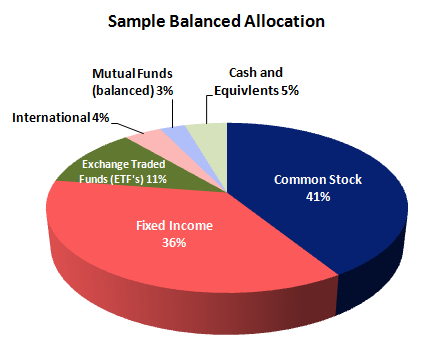

US Asset Management provides Pension Plan clients of all sizes with custom-built, balanced portfolios that achieve maximum returns with the lowest possible risk.

Investment Approach and Strategy

We aim to reduce risk exposure, while seeking to slightly outperform the agreed-upon benchmark.

Through many years of refinement, we developed our Risk-Based Quantitative Methodology (RBQM), which enables us to seek gains over the benchmark with reduced risk.

We apply a similar methodology to all asset classes, including equity, fixed income, and international investments.

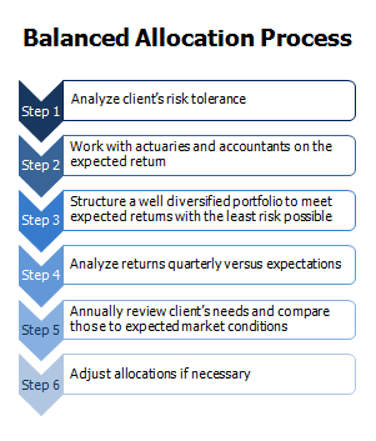

Our Balanced Allocation Process

US Asset Management will work closely with our clients’ custodians, accountants, auditors, actuaries or other key professionals in developing their portfolios and setting mutually chosen benchmarks.