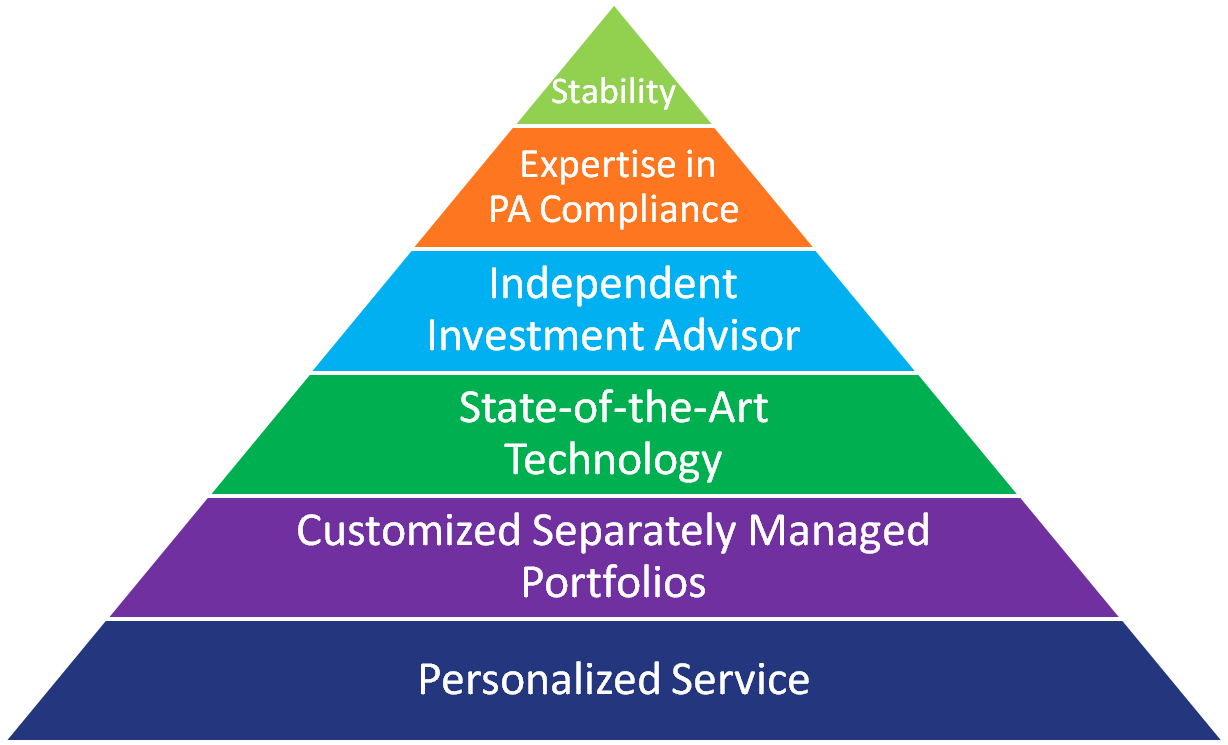

Personalized Service

We create customized, well-diversified portfolios based on clients’ risk tolerance and objectives.

We continually monitor your investment allocation and are extremely responsive to changing client needs.

At US Asset, we value a close working relationship with our clients and are happy to meet according to your time frame.

Customized Separately Managed Portfolios

We analyze all clients’ allocations yearly to ensure an appropriate investment risk.

State-of-the-Art Technology

- compile and analyze your portfolio

- create customized reports suited to your needs

We maintain over 15 years of data in a massive database of over 33,000 securities that is updated continuously.

Independent Investment Advisors

Remaining unaffiliated empowers us to:

- implement an investment strategy involving only the client’s best interests

- advise our clients without conflicts of interest

We never purchase investments that benefit any party except our clients.

Compliance

- Pennsylvania-based US Asset has a high degree of expertise in PA municipal codes.

US Asset Management adheres to all GIPS (Global Investment Performance Standards) as mandated by the CFA Society and is subject to external audits on an annual basis.

We are happy to work with you on developing appropriate investment policy statements.

Stability

No affiliations

No subsidiaries

No parent companies