US Asset Management offers individually crafted portfolios that generate higher yields than traditional money market rates for clients who hold considerable amounts of cash for capital projects.

When money market rates hit 0% after 2008, we realized the need to earn much better yields for our clients, while maintaining the lowest possible levels of risk.

Over the past decade, all of US Asset Management’s cash accounts have realized net yields above those offered by their custodian.

US Asset Management has worked with accounts ranging from $1M to $120M in assets.

Investment Approach and Strategy

Risk reduction is our first and foremost priority, as with all portfolios at US Asset Management.

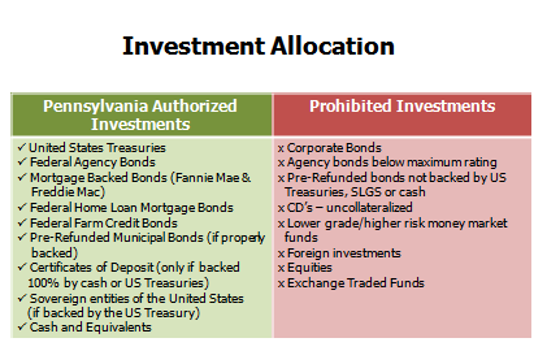

Our cash management strategy is to invest as much of clients’ bond proceeds as possible while adhering to local and state investment codes.

All investments are made within Pennsylvania State Municipal Code.

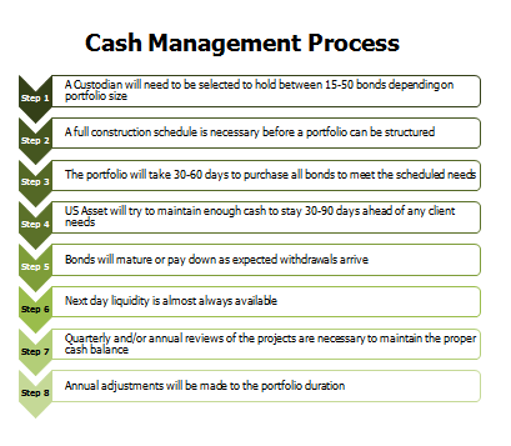

We work very closely with our clients, their engineers, investment bankers, and other professionals who determine anticipated draw down schedules. We make sure sufficient excess cash flows are on hand to ensure no delays in cash availability.